Small Business - Automobile Taxable Benefits

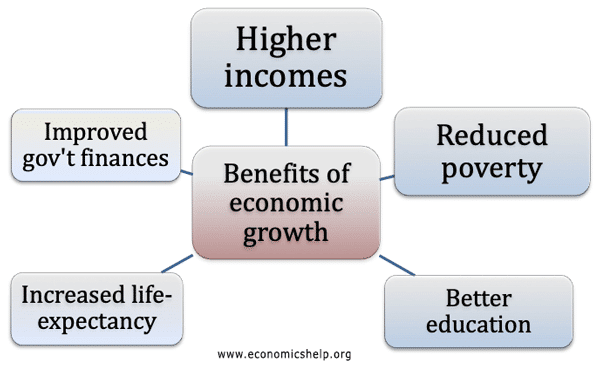

Description

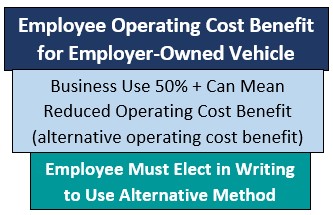

Automobile Taxable Benefits - Operating Cost Benefit, Reduction if Business Use 50% +

Machen McChesney Blog

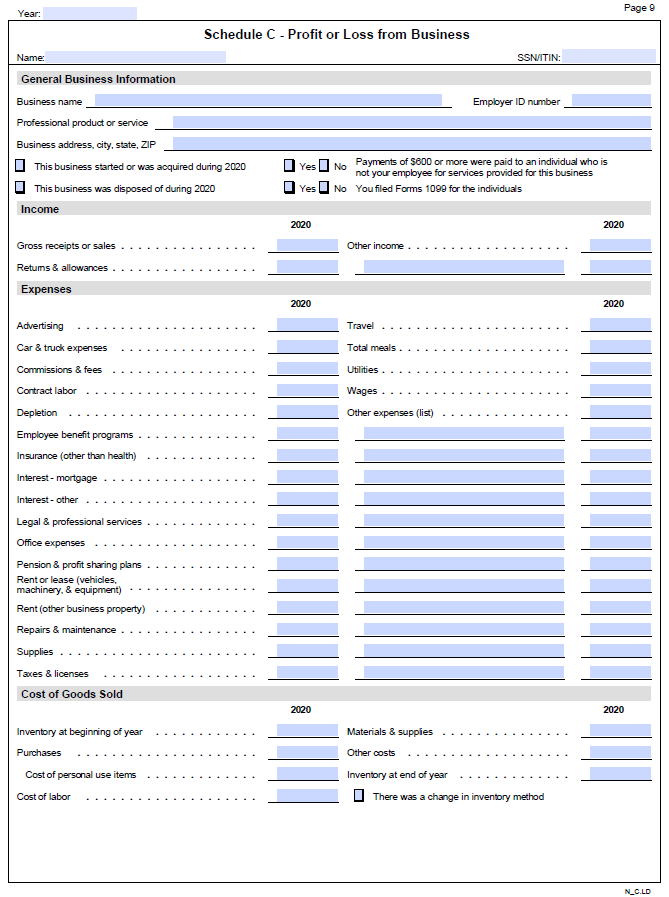

Schedule C Small Business Organizer - Daniel Ahart Tax Service®

Strategies: 7 things to do now for your small business

A Company Car is a Valuable Perk but Don't Forget About Taxes

A Guide to Business Vehicle Tax Deductions

How Small Business Owners Can Combine Section 179 and Cost Segregation to Reduce Tax Liabilities and

Is Buying a Car Tax-Deductible in 2024?

Section 179 Tax Benefit

Tax Rules for Personal Use of a Company Vehicle - GTM Payroll

2024 Everything You Need To Know About Car Allowances

Tax Rules For Buying A SUV Or Truck To Deduct As A Business Expense

Related products

You may also like

$ 7.00USD

Score 4.8(408)

In stock

Continue to book

You may also like

$ 7.00USD

Score 4.8(408)

In stock

Continue to book

©2018-2024, womanofelegance.com, Inc. or its affiliates

:max_bytes(150000):strip_icc()/BenefitPeriod_final-c081a540fe86421ca5e9906d9349eaf5.png)